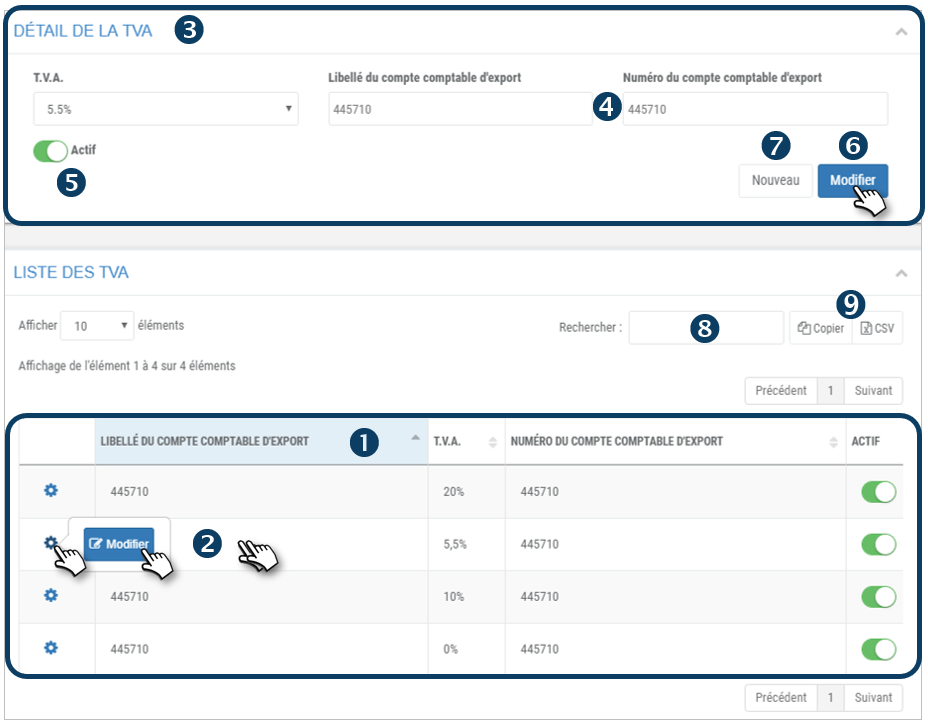

Define your VAT rates and accounting account numbers

This setting is essential for your exports to your accounting software.

1. The various usual VAT rates are already filled in and an account number must be associated with them (e.g. 445710).

2. To view and modify a VAT account, double click on the corresponding line in the VAT list or click on

3. The details are displayed in the upper part.

4. Enter the Name and number of the export account for exports to your accounting software.

5. By default, the VAT rates are ACTIVE but you can make them inactive by dragging the cursor. This corresponds to rates that are no longer used or obsolete.

6. Click on EDIT to SAVE your changes.

7. Click NEW to SAVE a new VAT rate.

8. You can perform a keyword search by entering the beginning of the supplier you are looking for.

9. You can copy the content of the table or export it in .csv format.